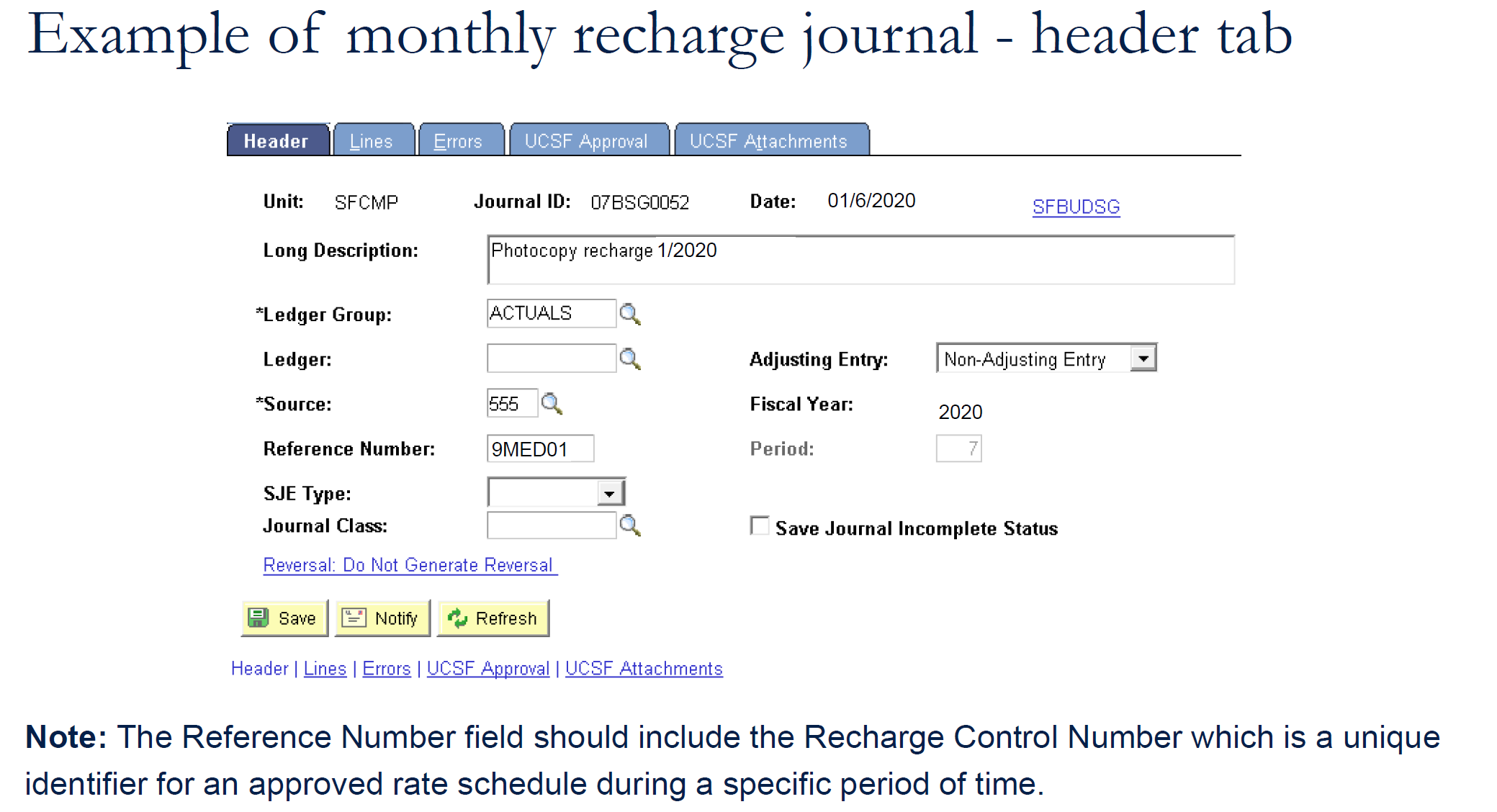

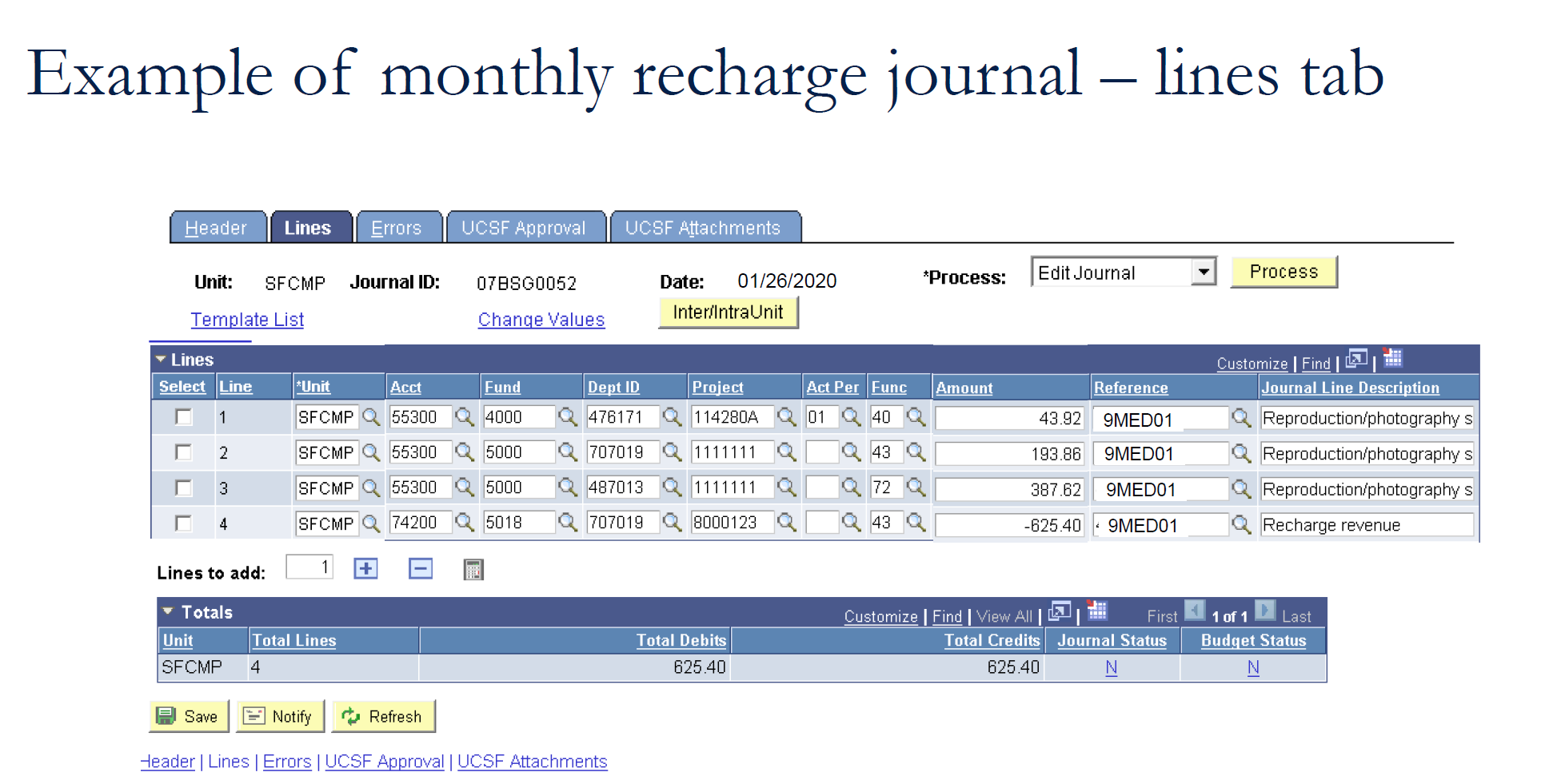

How to prepare a monthly recharge journal

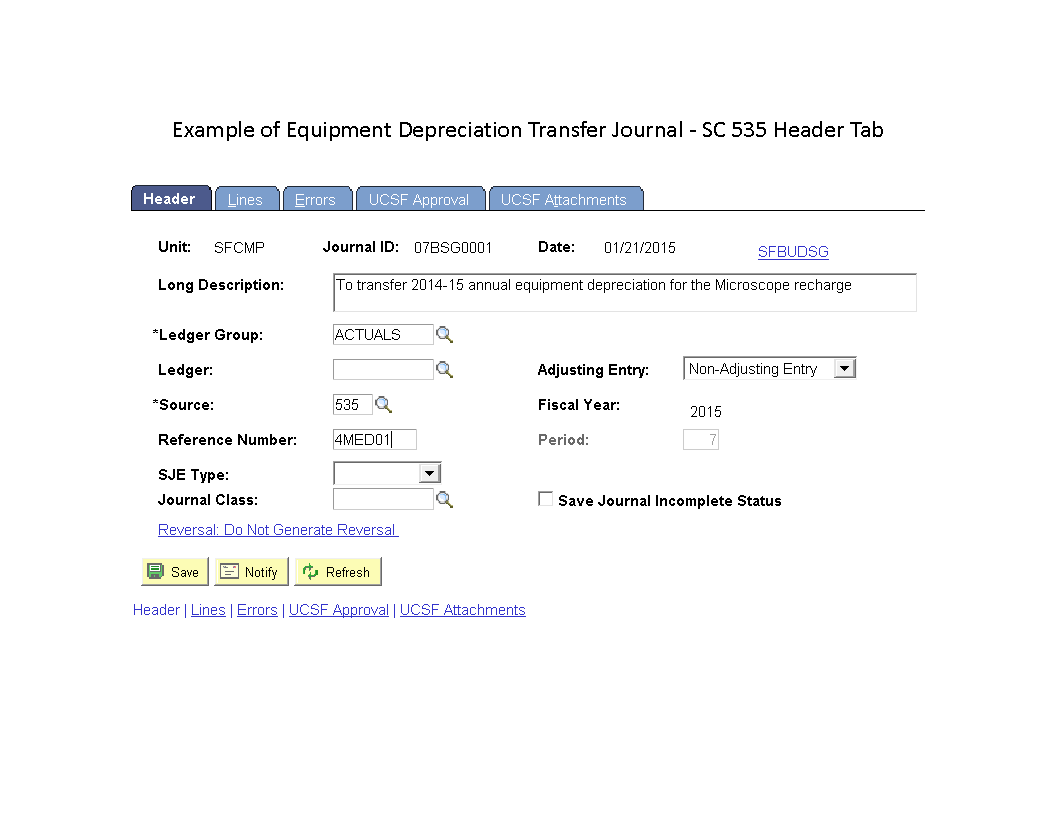

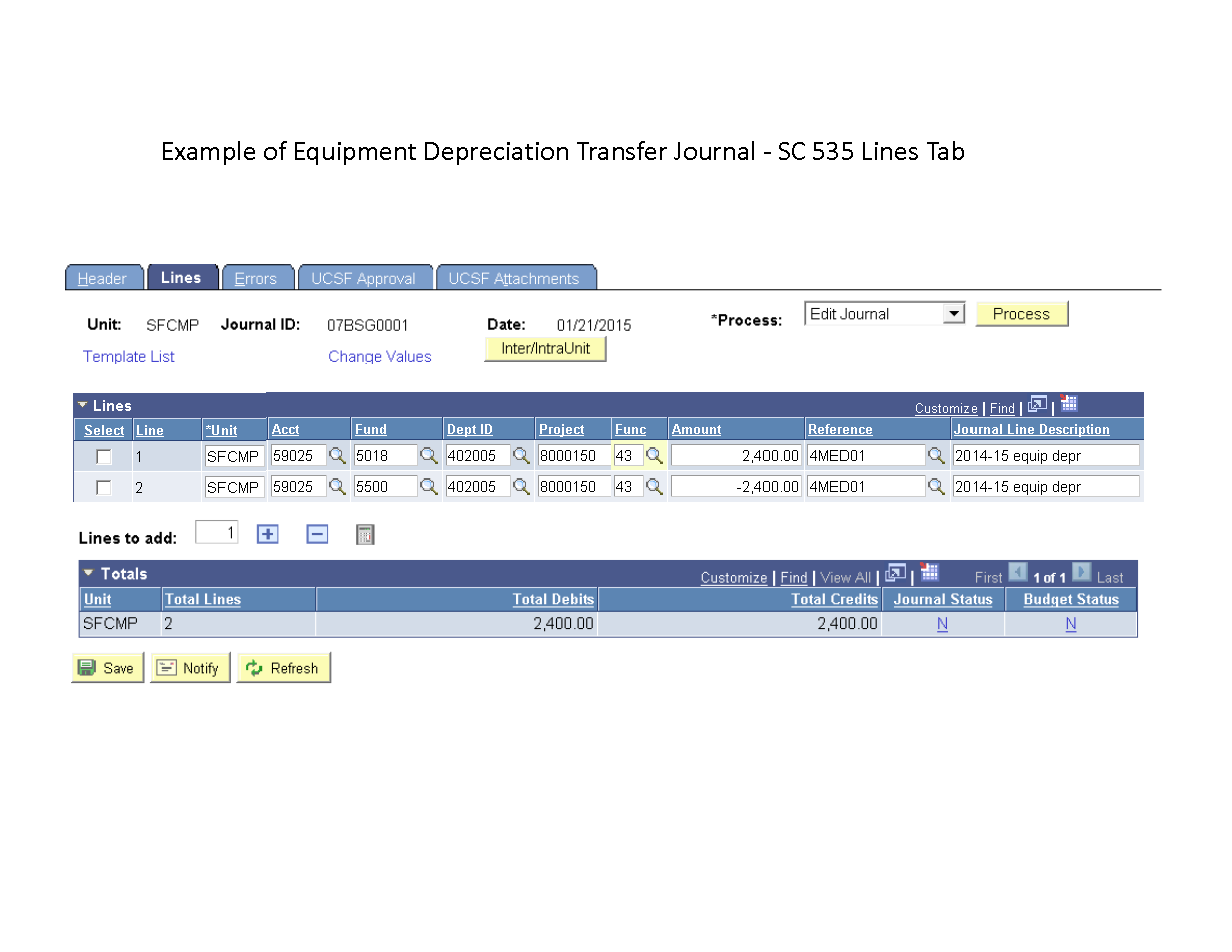

How to prepare an equipment depreciation transfer journal

How to apply a Subsidy to a Recharge

Recharge Activities may be subsidized from other funding sources and may be applied in the following ways:

Non-Federal Subsidies

- Billing Subsidy

- General Subsidy

- Subsidy for Specifically Identified Expenses

Federal Subsidies

- Billing Subsidy (No Program Income)

- Recharge with Federal Subsidy (Subvention) (Program Income)

Application of Non-Federal Subsidies to Recharge Rates

| Non-Federal Subsidies | Guidelines | Examples |

|---|---|---|

| 1. Billing subsidy |

To reduce the rate charged to the users for recharge products or services by charging a portion of the billing rate directly to a subsidy project.

|

The fully costed rate of a recharge service is $100 per unit. Eligible users receive a 20 % billing subsidy from a subsidy project. The subsidy project pays $20 by charging the subsidized portion of the rate directly to the subsidy chartstring and the users get charged $80.

|

| 2. General subsidy |

To offset overall expenses in the recharge operating project.

|

The department transfers year-end deficit balance from the recharge project to a departmental discretionary project or transfers subsidy to recharge operating project during fiscal year to offset expenses and lower the rate.

|

| 3. Subsidy for specifically identified expenses |

To pay for specifically identified expenses of the Recharge Activity by charging the subsidized expenses directly to a subsidy project.

Since all costs and revenues should be recorded in the recharge project, this option has been removed from the guidelines. However, in certain cases might still be allowed if exceptional approval has been received from Budget and Resource Management.

|

The subsidy fund source specifically requires that certain costs are directly charged to the subsidy project (i.e. faculty and staff effort, supplies, etc.)

|

Application of Federal Subsidies to Recharge Rates

| Federal Subsidies | Guidelines | Examples |

|---|---|---|

| 1. Billing subsidy |

To reduce the rate charged to the users for recharge products or services by charging a portion of the billing rate directly to a federal

award.

The billing subsidy process results in no program income reporting requirement to a federal award, only direct costs.

|

The fully costed rate of a recharge service is $100 per unit. Eligible users are receiving 20 % billing subsidy from a federal project. The federal project pays $20 by charging the subsidized portion of the rate directly to the federal award and the users get charged $80.

|

| 2. Recharge with federal subsidy (subvention) |

To apply a federal subsidy to offset recharge

expenses (subvention) and lower the rate charged to all users. In this case, the recharge is classified as a program income activity and must report program income and account for as specified by the Controller’s Office.

Budget and Resource Management’s role is to

review and approve the rate calculation methodology and rate schedule.

|

The federal award subsidizes the recharge service cost to reduce the rate charged to all eligible users. Costs and revenues related to the recharge activity are recorded in a subproject under the award’s primary project. Costs subsidized by the federal subvention are recorded in the award’s primary project or in a secondary project.

|

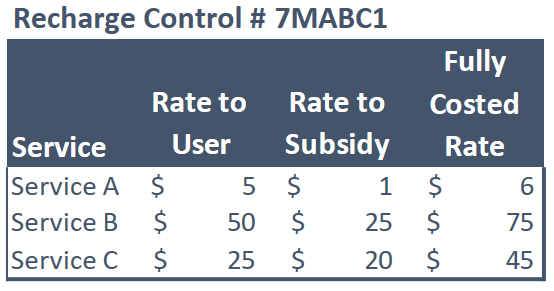

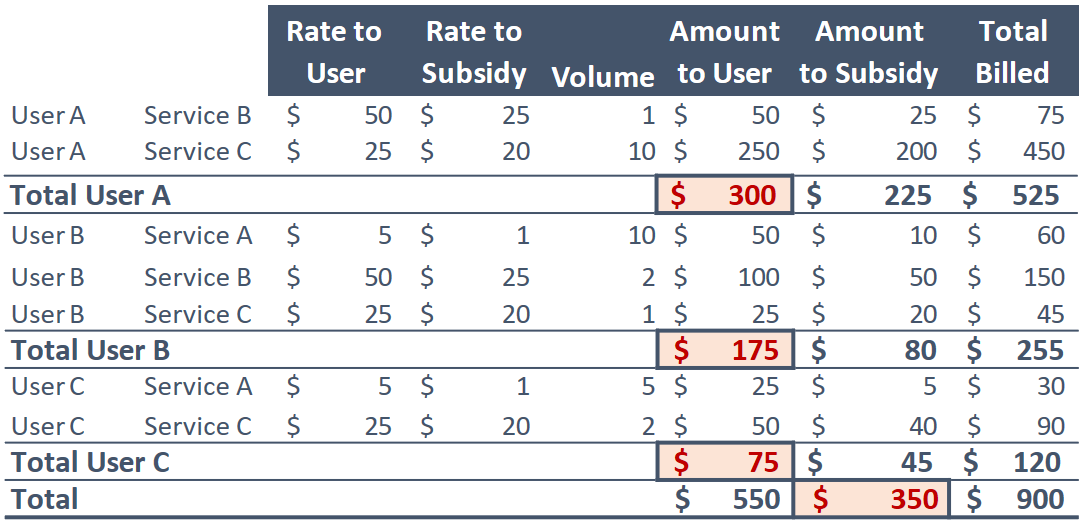

Billing Subsidy Application

When a subsidy is applied to billing rate for all internal users, the subsidized portion of the rate is charged directly to the (federal or non-federal) subsidy fund, and the remaining portion of the rate is charged directly to the user.

Approved Rate Schedule

Monthly Usage

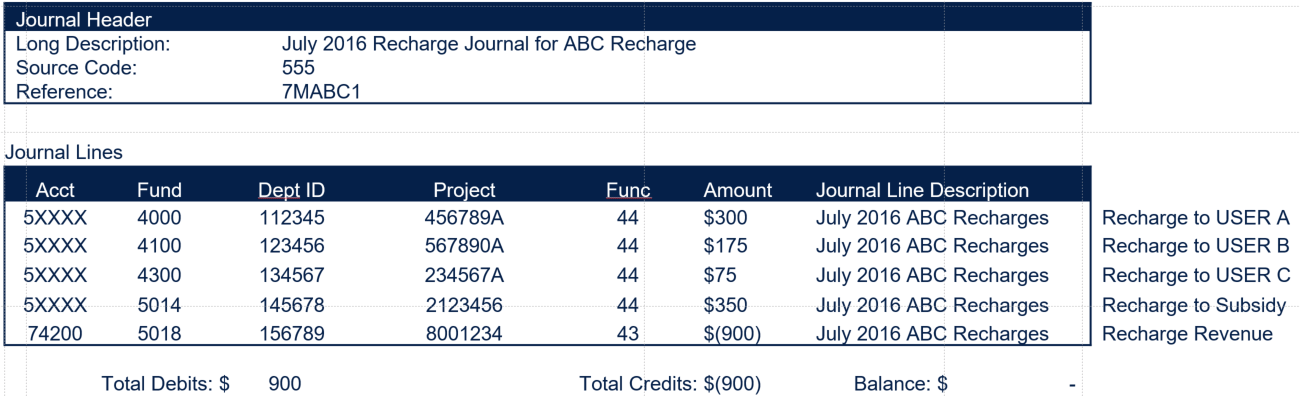

When preparing a recharge journal with a billing subsidy, only one additional journal line is needed to recharge the billing subsidy fund source.

Recharge Journal

General Subsidy Application

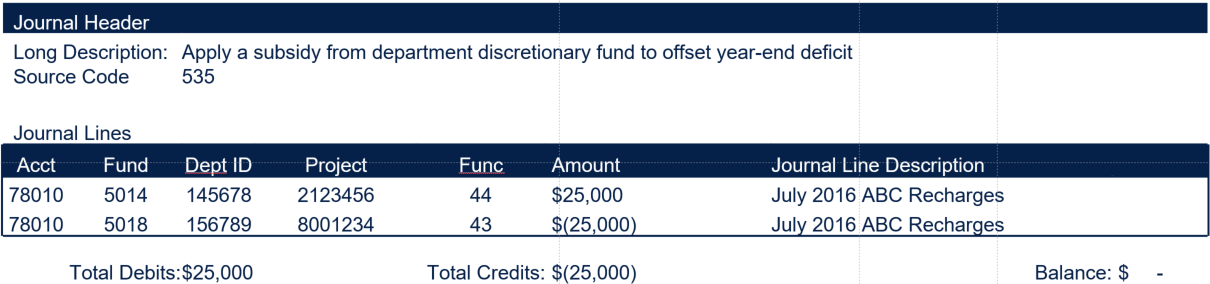

When a subsidy is applied to offset overall expenses, all or a portion of the recharge deficit may be transferred to a departmental discretionary fund source using the appropriate transfer account per section 5 of the COA Moving Money Quick Reference Guide. Generally, deficits related to external users shall not be transferred to subsidy fund.

Financial Journal

Subsidy Application Q&A

Is there a preference to using the billing subsidy application vs. the general subsidy application?

The billing subsidy application is preferred in order to maintain fund integrity, and for federal subsidies, avoid program income reporting requirements to a federal award.

If the general subsidy is applied, how often can transfers occur?

Subsidy transfers can occur at any time during the fiscal year, and as often as necessary.

Can a subsidy be applied to external users?

A subsidy may only be applied to external users if the subsidy fund source allows funding to benefit external users. When subsidies are applied to both internal and external users, the subsidy should offset expenses for rate calculation for all users.

Can a subsidy be applied to a specific group of users?

A subsidy can be applied as an offset to rates charged to a specific class of users (e.g.: a certain class of internal customer, such as students, are subsidized from an instructional funding source).

How to calculate billable hours for an hourly rate

Billable Hours Calculation Worksheet*

When calculating a rate based on a per hour labor service unit, the rate per hour should reflect only the employee’s billable time. Billable hours are calculated by deducting non-billable time (vacation leave, sick leave, holidays, and administrative time) from the annual working hours.

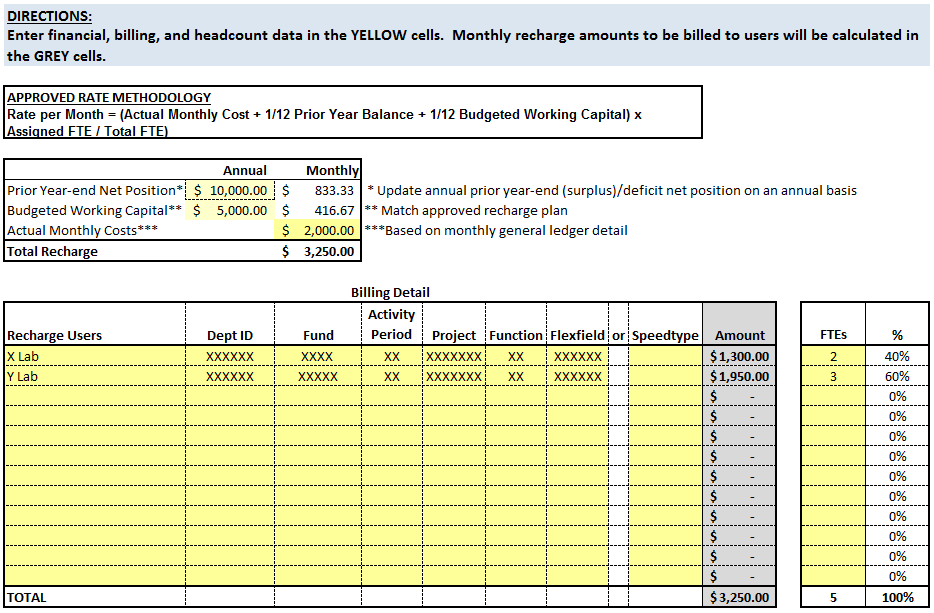

How to calculate monthly recharge journals for a Common Cost Allocation Recharge

Common Cost Allocation Recharge Worksheet*

For Common Cost Allocations, the monthly rate is a formula rather than a set dollar amount. This worksheet can be used to assist in calculating monthly recharge journals based on your approved rate formula.

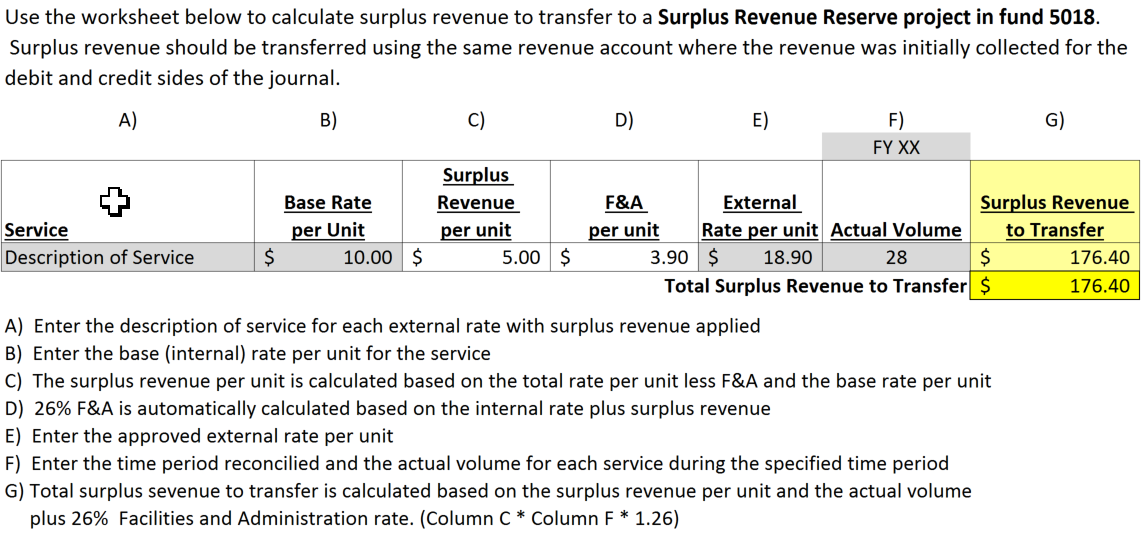

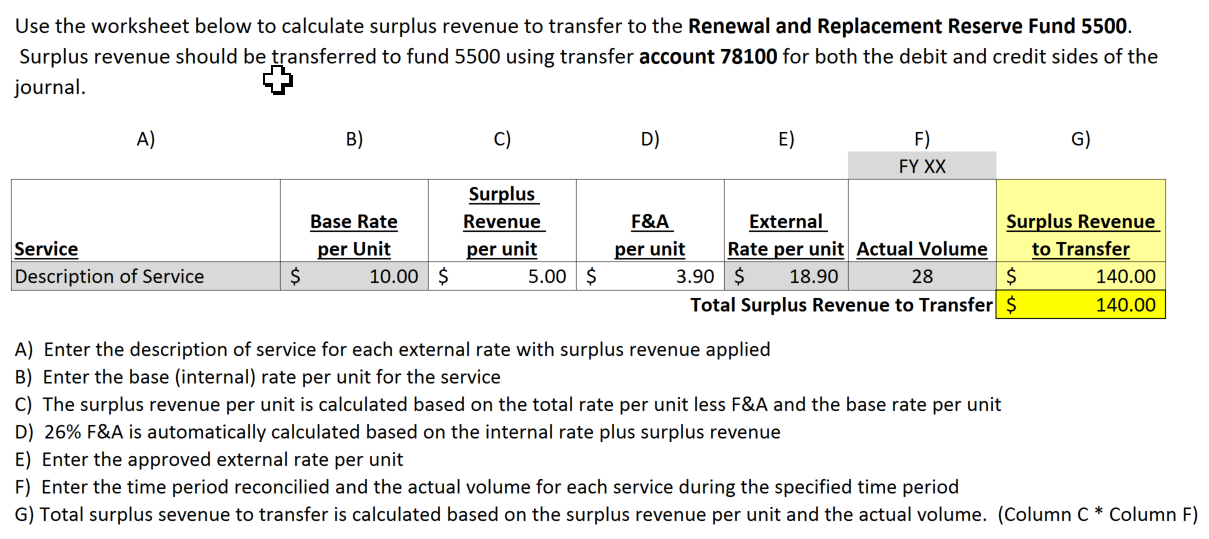

How to reconcile surplus revenue collected from external users

Reconciliation of Surplus Revenue Worksheet*

Surplus Revenue may be retained on the recharge fund as an offset to expenses, transferred to the associated Renewal and Replacement Reserve Fund (5500) to be used to make capital purchases to support the recharge activity, or transferred to a Surplus Revenue Reserve project associated with the recharge to be used in a manner that supports the recharge activity.

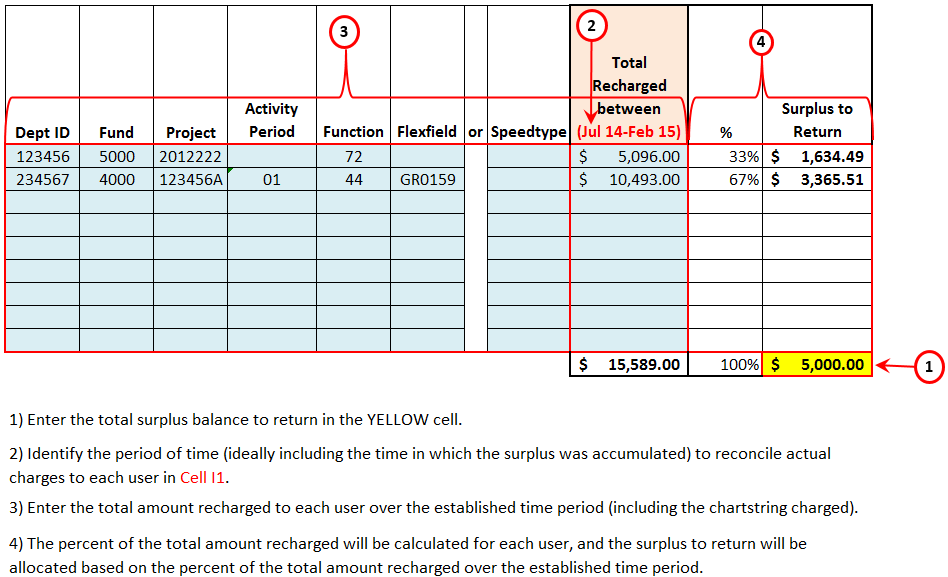

How to treat a surplus net position when discontinuing a recharge

Treatment of Surplus Net Position when Discontinuing a recharge*

An ending surplus net position is generally returned to the recharge users when discontinuing a recharge activity. The following worksheet can be used to assist you in calculating the surplus to return to the recharge users.